Deal Structure: Purchase Option Buyback

Many first-time entrepreneurs, when discussing their fund raising needs, often close with, Ō... and I donÕt want to sell any equity.Ķ

Tilt? Not really.

The vast majority of start-ups will not go public, nor get acquired. Yet, those who invest in such companies do want to get a return on their investment. Being the shareholder of a closely held corporation may not be the right structure for such investors.

It is possible to satisfy the entrepreneurÕs desire for retaining his equity and the investorÕs desire for a return on his investmentÉ

Deal Mechanics

LetÕs say you wanted to secure $500,000 for your company,

but like last weekÕs entrepreneur, you donÕt want to give up any equity. LetÕs

also say that IÕm willing to provide that funding using this weekÕs

structure. HereÕs how that would

work:

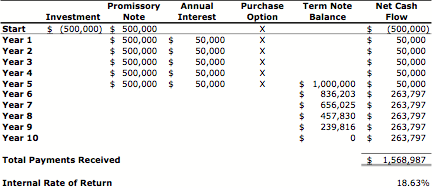

I will lend your company $500,000 (the Loan) with simple

annual interest of 10% payable quarterly (guaranteed by the company and you,

personally).

The note matures on its fifth anniversary, meaning that

youÕve got to pay me off at that time, although IÕm willing to work with you to

do that if certain conditions are met (described later).

WeÕre not done yet.

In addition to the note, I get an option to buy 51% of your

company for $500,000 that I can exercise on the fifth anniversary of the note

(the Purchase Option).

At the same time, you get an option to buy my Purchase

Option for $500,000. This right

expires in the fifth anniversary of the note (the Purchase Option Buyback).

If you can satisfy me that you can honor a new note at that

time, IÕm willing finance your obligations to me. In other words, I will lend you $1,000,000 (retirement of

the original note ($500,000) plus purchase of my Purchase Option

($500,000)). This will be a

five-year term note at 10%, just like a car payment.

As compared to other deal structures that IÕve discussed, an

annualized rate of return of less than 19% may appear to be a bargain to you,

but it isnÕt really. First, your management options will be constrained by this

deal. Also, itÕs really two deals.

The annualized return on the original $500,000 is over 22%. Then the loan of

$1,000,000 is done at 10%, yielding a blended rate of 18.63%.

Considerations

This is a classic Ōcarrot and stickĶ deal. You get money at a time when you need

it without giving up any equity. BUT, if you arenÕt able to exercise your

option to buyback my Purchase Option, I can take the note that you owe me and

use it to buy 51% of your company as of the noteÕs fifth anniversary. The

presumption is that the ŌstickĶ will provide you with the necessary motivation

that you will do everything in your power to avoid that outcome.

The EntrepreneurÕs

Perspective

First and foremost, you can avoid selling equity in your company.

This structure also has the benefit of not having to establish a value for the company. Since valuation is often a stumbling block for getting entrepreneurs and investors together, avoiding that impasse is a very real benefit. (Even the Purchase Option is defined in dollars. If itÕs exercised, the valuation at that time is already defined.)

ItÕs pretty straightforward in terms of administrative overhead.

A very important consideration for you is that the nature of this deal will force you to aggressively manage for cash flow. Unlike equity deals that are targeted at capital gains, this deal is exclusively cash-on-cash.

Another reality is that youÕd better make sure that this money is all that you need because this deal structure will make raising money from other sources virtually impossible.

The InvestorÕs Perspective

First, IÕve got a deal that will triple my money, and then some.

Trying to fit a square peg into a round hole is never wise. I must exercise great discipline in the selection of companies that will qualify for this form of investment.

In terms of protection, if the company canÕt satisfy the terms of the deal on the fifth anniversary, I can convert my note into 51% of the company and take control. Then I can try to salvage whatever value I can for my investment.

Concurrently, I am betting on the belief that the prospect of this outcome will drive you to avoid it.

It is also true that if the initial investment doesnÕt get the company to cash-positive operations, I am probably the only realistic source of additional financing.

Cautions

As I said in the opening, this may not be the right deal structure for a start up. Without existing revenues to use as the basis of a forecast, it is difficult for either potential participant to have sufficient confidence in the companyÕs ability to satisfy this deal structure.

All parties must consider tax consequences. As tax laws change, the relative

attractiveness of this structure may increase or decline.

Advice to entrepreneurs

- Deal structures are only limited by the imaginations of the involved parties.

- It is possible to structure deals without giving up equity.

- Use good professionals to make sure your deal is structured properly.

Frank Demmler is Associate Teaching Professor of Entrepreneurship at the Donald H. Jones Center for Entrepreneurship at the Tepper School of Business at Carnegie Mellon University. Previously he was president & CEO of the Future Fund, general partner of the Pittsburgh Seed Fund, co-founder & investment advisor to the Western Pennsylvania Adventure Capital Fund, as well as vice president, venture development, for The Enterprise Corporation of Pittsburgh. An archive of this series of articles can be found at my website.